Table of contents

Reflect Festival is the tech event of Cyprus, it is unique both for its being a bridge of innovation between Europe and the Middle East and for its ability to give value to an ecosystem that is structuring itself to become increasingly competitive both from the point of view of business creation and access to public funds and private financing without neglecting the tax structure that proves to be much more agile than that of many other EU countries. Startupbusiness chose to be a media partner of this edition of the festival, which took place on May 30 and 31, and followed it directly thanks to the work of Daniela Bavuso, who lives and works in Cyprus and who produced the report.

At the crossroads of Europe and MENA (Middle-East and North Africa) countries, Cyprus, is consolidating its position as one of the most promising technology innovation ecosystems in Europe.

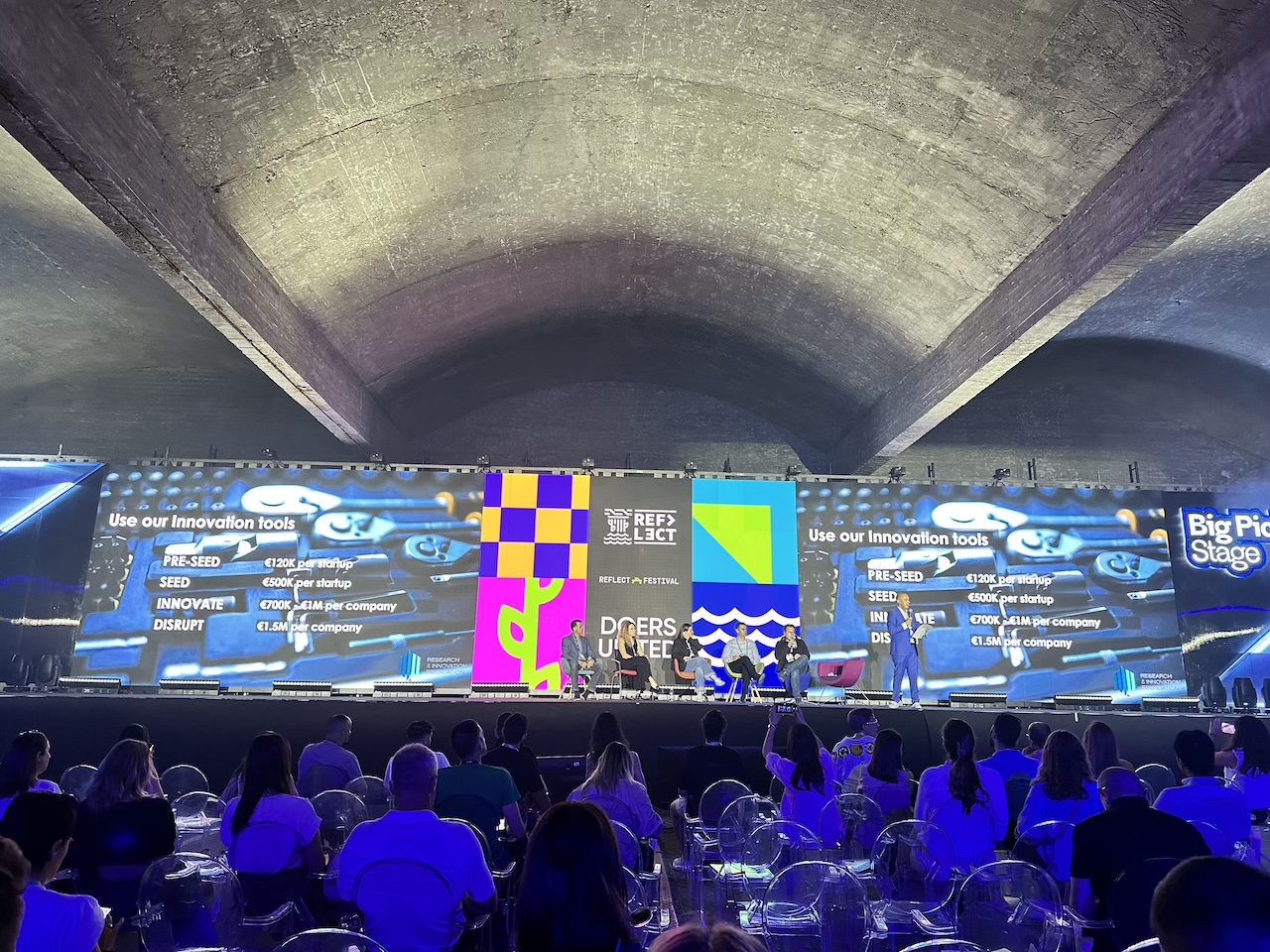

Reflect Festival in Limassol is the island’s most important technology event in its seventh edition, where more than 10 thousand investors, companies, startups, research centers and local and international institutions shared ideas and visions in a major international networking event in which we also participated as a media partner.

This is confirmed by StartupBlink’s “Global Startup Ecosysterm Index 2024,” which this year sees it advance nine places in the global index and reach 45th place in the rankings (Italy is ranked 28th), surpassing ecosystems such as Malta (55), Saudi Arabia (65) and Qatar (79) and closing the gap that separates it from ecosystems such as the whole of Chile or Turkey (ranked 39th and 40th, respectively).

From the “born global and exponential” mentality to the go getters style of local businesses, via welcoming tax policies and a no small record in the use of European funds, making the island a gravity creator in attracting alternative resources to private finance in the Mediterranean, we tell you what phenomena have made this patch of Mediterranean land, until recently known mainly for archaeo-tourism and crystal clear waters, a friendly tech-hub to certainly watch out for.

Strong ideas for international markets

With its population not even approaching that of metropolitan Milan and its approximately 100 inhabitants per square kilometer of which more and more are expats and “taxpats,” it is not hard to believe that Cyprus is a country with an extremely small domestic market.

The consequence is that those who give birth to their idea in a garage or in one of the island’s increasingly popular pied-dans-l’eau co-working spaces know immediately that they cannot count on a home market and will have to deal with a larger, unfamiliar dimension. Internationalization as we understand it in Italy: make your business and then choose whether, how and when to take it outside the borders, is an uncommon concept here: you can only be born global and keep yourself “light” in structure in order to be able as soon as possible to espouse the principles of an exponential growth model.

Attractive hub

In a context such as the island, diverse enough to allow you to find the team with the skill-set you want, but small enough to simplify relationships between companies, funds and institutions in a way that allows organizations to communicate and collaborate for the competitiveness of individuals and the system, it is easy to secure the key elements of the right kick-start: international mindset and team diversity, public support within workable timeframes, diversification of funding sources, open innovation opportunities and testing in nearby markets. In recent years, then, there have been tremendous efforts to make the island an attractive destination for European and Asian entrepreneurs, the accomplice also being a friendly and relaxed environment, the building development of increasingly qualified urban areas, quality services to families in ever-increasing numbers, and modern infrastructure. Cyprus is, moreover, increasingly a focus of attention for multinational oil and gas companies and from European countries because of its key role as a European energy hub.

Simple taxation

On the tax and red tape side, the island’s tax policy is more than accommodating, as Harris Georgiades, former minister of finance and current chairman of the Foreign and European Affairs Committee of the Cyprus House of Representatives, points out : “Over the years, Cypriot governments have been able to sustain an attractive, competitive and business-friendly economic environment. For nearly a decade, the country has operated with a balanced budget, which in turn has enabled the promotion of significant fiscal incentives. Corporate tax is 12.5 percent, the top VAT rate is 19 percent, and employment subsidies are lower than the EU average. A very significant tax incentive for people coming to Cyprus to take up employment is the 50 percent or 20 percent deduction on personal income tax, offered for 17 years.”

Research and European funds

After his speech Theodoros Loukaidis, director-general of the Cyprus Research & Innovation Foundation- RIF (the national funding agency for research, technological development and innovation in Cyprus) tells us that the country is a strong innovator for the second year in a row in the European Innovation Scoreboard published by the European Commission: “We have a very vibrant local ecosystem with 4,000 entrepreneurs, nearly 60 venture capitalists, and more than 800 active startups and scaleups establishing themselves in international markets from Cyprus, as well as 12 universities, several research institutes and 7 centers of excellence with significant innovation capacity in the fields of climate change, sustainable energy, digital technologies, maritime and naval transportation, space and earth observation and life sciences, to name a few.” The RIF in Cyprus catapults Cypriot organizations into the EU’s research and innovation program, Horizon Europe, and in general, when it comes to grabbing European grants, Cyprus is a formidable competitor for other Mediterranean countries.

Startups in Cyprus

Many successes in the Cypriot market come holes from RIF programs of their own. Some examples: Malloc, a cybersecurity startup backed by Y-Combinator, now has more than one million users worldwide and has raised a $2 million investment. Nodes and Links, a startup offering artificial intelligence software solutions for managing large engineering projects, has customers internationally and has raised $11 million in investment. Cyprus‘ first biotechnology company , NIPD, was successfully acquired in 2022 by Medicover. EnergyIntel has developed a very innovative energy storage system and is expanding internationally from Cyprus. The company acquired the assets of a NASDAQ-listed Nordic company. Many of the startups in attendance are waiting for their moment to launch , at Reflect we met Waddah Albassam CMO of Alphaiota and founder of SmartHealth Medical Company, a patient care program designed to provide comprehensive healthcare solutions integrating artificial intelligence: “We are present at Reflect to intercept of strategic investors to support our expansion into different markets and to share strategic visions in this area in the region.”

GameTree is a social platform for gamers. “The younger generation spends much of their time playing games, and we want to provide them with a safe and friendly environment to build friendships and community,” says Dana Sydorenko, founder and CEO . We want to make players less lonely and decrease the toxicity of the game. We have raised $1.7 million and are raising $4 million. Here at Reflect I am interested in networking and meeting great companies from Cyprus and Europe. The event has a fantastic reputation for being not only productive but also fun and for gathering the best people in one place to learn, have fun and enjoy the sunshine island.”

Motivated investors

As Georgiades also points out, there are additional tax breaks for investment in innovative companies that make Cyprus one of the most attractive destinations for business and investment in the EU, and, Loukaidis adds, “There are a number of programs to attract talent and investment to the country, including tax and visa incentives for qualified individuals and investors.”

Victoria Kostic-Nola GM, angel investor & advisor and one of the most established “Cyprus’ startup community builders,” explains how although the current geopolitical landscape is affecting the flow of investment, in general Cyprus has seen a lot of activity in investment support that now makes the island an optimal business base for MENA companies wishing to expand/invest in Europe, but also a springboard for European companies wishing to enter the MENA area.

System stability

Cyprus is the gateway to Europe for MENA countries and, as Georgiades points out, “It has excellent trade and political ties with Israel but also with Arab nations in the region, a member of the EU and the Eurozone, but also a country with strong ties to the Middle East, the Caucasus and Central Asia.” This country in its geographical context is also and anchor of stability in the region.

And speaking of the situation in neighboring countries, we were able to chat with Nicolas Rouhana, chairman & CEO of IM Capital & IM Ventures, active in the neighboring Lebanese ecosystem since 2001, who told us how Lebanon’s economy since 2019 has been hit by multiple crises, including a financial downturn that has led to economic instability. This has restricted financial flows and private investment, leading to a significant increase in unemployment rates, with a particular impact on female labor force participation. In addition, the scarcity of available capital, largely trapped in low-value banks, has been a significant challenge for businesses and startups, affecting economic development and hampering efforts to reduce unemployment. The performance of the then nascent startup industry was significantly hampered, forcing 7 VCs out of the market. Of the $650 million in funds pledged by banks, only $200 million has been used. Funding from private investors has also dried up. The only remaining sources of funding for VCs were international support organizations such as the World Bank, USAID, and EU support funds, which changed their priorities after the October 2023 war in southern Lebanon. These organizations allocated a total of $50 million before the crisis and $12 million during and after the crisis. The remaining 4 VCs are estimated to have only $50 million to deploy, mainly from these organizations.

Here, too, it emerges how, for companies in the region, differentiation of funding sources not only ensures resilience but also timeliness in research and innovation .(author’s photo)

ALL RIGHTS RESERVED ©