Italian Angels for Growth presents the 2023 edition of its IAG Index , which photographs the ecosystem of Italian startups seen through the eyes and direct experience of the business angels of the historic investment group and which takes momentum from the report presented in October and relating to the first six months of 2023 and from that relating to last year.

IAG Index starts from the data of the latest quarterly Observatory on venture capital in Italy by Growth Capital and Italian Tech Alliance, in 2023 investments in startups and innovative companies in Italy amounted to 1.17 billion euros in 325 rounds of financing, recording a decrease in the amount invested of 37% compared to the previous year, mainly due to the lower incidence of mega rounds (17% vs 38%), with the number of rounds essentially stable (339 in 2022 and 325 in 2023). Here is the full report that was presented in January 2024 and of which we wrote in depth.

On the other hand, the significant increase in the number of active early-stage investors, with the creation primarily of several funds in this sector (such as, for example, Italian Funders Fund) and the contribution of vertical accelerators promoted by CDP VC, has led to a strong growth in the number of pre-seed rounds (92 in 2023 compared to 55 in 2022).

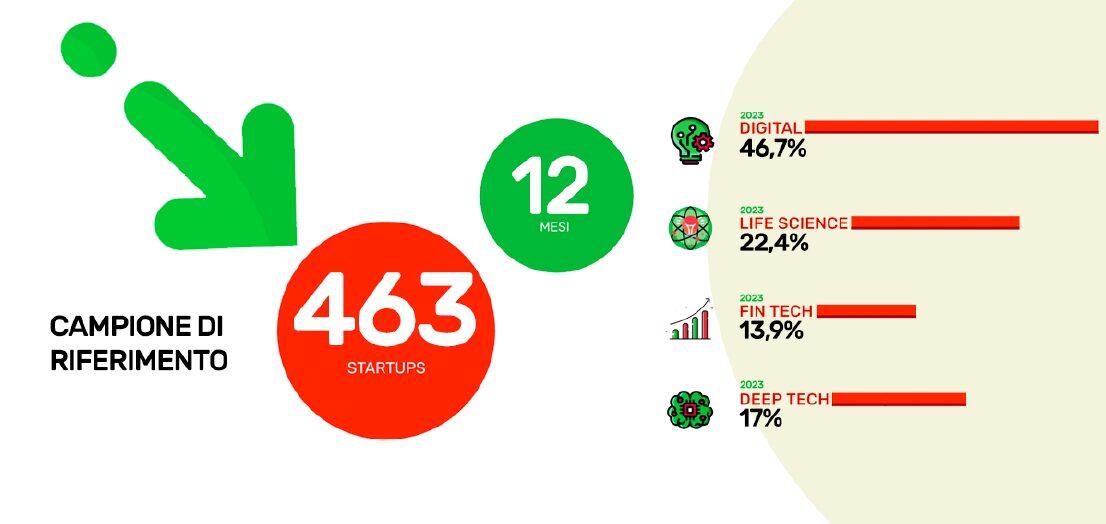

An element that also emerges from the data of the IAG Index, a thermometer of the startup ecosystem and calculated on the deal flow of startups analyzed in the selection of investment opportunities of Italian Angels for Growth (IAG), whose focus is precisely in the early stage.

In fact, despite the overall contraction of the market, the early stage recorded consistent deal numbers. In pre-seed and seed, there was a slight increase, in line with the expansion of rounds, attributable to two main factors: venture capitalists have moved towards the early stage with larger investments than ‘informal’ investors (such as family, friends & fools), and many pre-seed rounds have been led by serial founders, who are known to attract considerable volumes of capital from the early stages. Both of these elements are positive signs of market maturity.

IAG, sensing the changes in the market, also launched Eden Ventures in 2022, an investment tool focused on re-seed startups that has already invested in over 12 startups and represents concrete support for top class teams through a methodical, streamlined, rapid and valuable investment approach for entrepreneurs from the earliest moments of the development stage of their ideas.

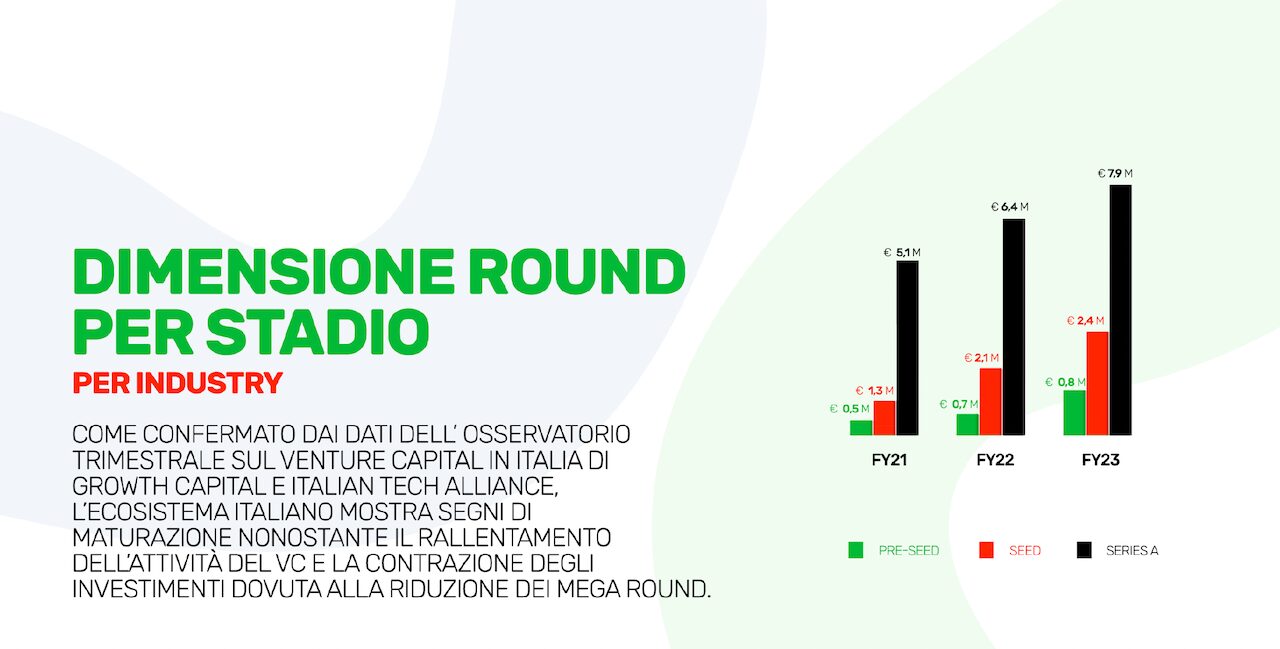

According to the IAG Index, the average size of pre-seed rounds is €8oo thousand, up 20% compared to 2022. The average seed round size is €2.4 million, up 15% compared to 2022. As the size of the rounds increased, so did the valuations of the companies. In terms of pre-money valuations, valuations have increased, despite the lower number of rounds in general. This trend is related to the fact that the market has become more selective and competitive. With this in mind, we can say that investors, because they are allocating capital at higher valuations, are confident in the potential growth of companies, including in the Italian market.

Internationalization, female entrepreneurship, sustainability

Specifically, IAG Index 2023 shows that 62.3% of the deals analyzed concern Italian companies. This result reflects the maturity of the Italian market, with Italian companies increasingly attractive to foreign investors thanks also to the commitment of public institutions in supporting the startup ecosystem, including the intervention of CDP VC’s international fund of funds, which is helping to attract foreign investors to Italy, as evidenced by the investment in the Partech fund, which has already approved an investment in Smartpricing.

Regarding women’s entrepreneurship, IAG 2023 data show a share that is still far from gender equality, stopping at 22.4%. However, compared to the European average (12.6%), Italy ranks above, reporting a more significant presence of women startup founders.

Another interesting aspect is the sustainability of startups: 70.3% of startups analyzed in 2023 said they have an ESG (environmental, social and governance) policy in their business model. This trend is particularly evident in the life sciences (94.9%) and deeptech (78.3%) sectors. On the contrary, deals in the fintech sector are less ESG compliant (42.9%), probably influenced by the more traditional nature of this sector, which is still evolving in terms of sustainability.

Carlo Tassi, president of IAG says in a notea: “The ecosystem is becoming more selective, which is a sign that the market is maturing. In addition, the creation of several funds and increased competition indicate that investors strongly believe in the development of the Italian venture ecosystem. Having understood the changing dynamics of the market, our engagement with Eden Ventures is in fact helping to increase the share of Italian pre-seed rounds. It is also important to highlight the growing focus on female entrepreneurship and ESG compliance, both of which are crucial factors in promoting the sustainable development of the ecosystem.”

ALL RIGHTS RESERVED ©