Table of contents

The Global Startup Ecosystem Report 2024 (GSER) by Startup Genome and the Global Entrepreneurship Network was presented at Tech Week in London, in collaboration with Founders Forum, Informa Tech and London & Partners. Presented by Stephan Kuester, managing partner of Startup Genome, the GSER analyzes data from more than 4.5 million companies in more than 300 entrepreneurial innovation ecosystems and presents rankings showing which ecosystems are currently driving innovation and in-depth knowledge of startup trends around the world.

Data from this edition include the significant drop in global VC funding, sharp decline in exit values, scarcity of IPOs, resilience of cleantech investments, and surge in funding for generative AI. The report also offers insights into the evolving dynamics of Series A financing, with a potential modest recovery in early-stage investment observed in the first quarter of 2024.

The main points of the report

The amount of Series A funding in 2023 decreased by 46 percent compared to 2022, and the value of large exits (over $50 million) dropped by 47 percent over the same period. The first quarter of 2024 saw a higher amount of round A financing and number of transactions than the fourth quarter of 2023. The number of new unicorns in 2023 is down 58% from 2022 and 87% from the peak in 2021. With 15 unicorns, Silicon Valley again leads all ecosystems for the most new unicorns in 2023, although down 80 percent from 2022. The startup ecosystems of Tashkent, Lyon and Rhineland saw the birth of their first unicorns in 2023.

In 2023, more than half of the new unicorns were in the genAI and deeptech subsectors, a higher rate than in 2021.

Late-stage cleantech startups raised 2.5 times more funding in 2023 than at their peak in 202. Europe has surpassed the United States and China in terms of growth in Series A cleantech funding from 2021 to 2023.

Generative AI has seen a surge in funding, with nearly 20 percent of all VC funding in 2023 going to genAI-focused startups. In 2023, VC genAI financing increased three times more than in 2022, and the number of transactions nearly doubled. In 2023, the share of Series A funding for the top 40 ecosystems ranked by GSER 2024 was 65 percent, down from 79 percent for these ecosystems in 2019. The share of Series A funding for the top 100 emerging ecosystems reached 19 percent in 2023 compared to 13 percent in 2019: Silicon Valley remains in first place, followed by New York and London tied for second place.

Seoul rose three places, now in ninth place, entering the top 10 ecosystems this year. Tokyo entered the global top 10 for the first time, marking the most significant improvement among the top 10 ecosystems. China’s top two ecosystems, Beijing and Shanghai, fell in the overall rankings to eighth and 11th place. Europe is the most represented region in the emerging ecosystem ranking, with a 42 percent share in the top 100 emerging ecosystems, followed by North America with 27 percent. Madrid climbed 12 places to the top spot in the emerging ecosystem ranking. Barcelona moved up two places in the ranking of emerging ecosystems to second place. Jakarta (sixth) and the Rhein-Ruhr metropolitan area (ninth) both made it into the top 10 emerging ecosystems. The Lausanne city region climbed 16 places to position 11 in the emerging ecosystems ranking. Mexico City has shown impressive growth, reaching the 21-30 range in the ranking of emerging ecosystems. Athens entered the ranking of 100 emerging ecosystems, reaching the 51-60 range in 2024. Melbourne ranks 32nd in global startup ecosystems, moving up one spot from the 2023 ranking.

“We continue to play our role as expert advisors dedicated to accelerating entrepreneurship and the growth of startup ecosystems and innovation clusters around the world. The Global Startup Ecosystem Report is the foundation of our mission,” Stephan Kuester, managing partner of StartupGenome, stressed in a note. Armed with the right knowledge, we work alongside entrepreneurs, policymakers and community leaders globally to demonstrate how innovative technologies can drive exponential economic growth.”

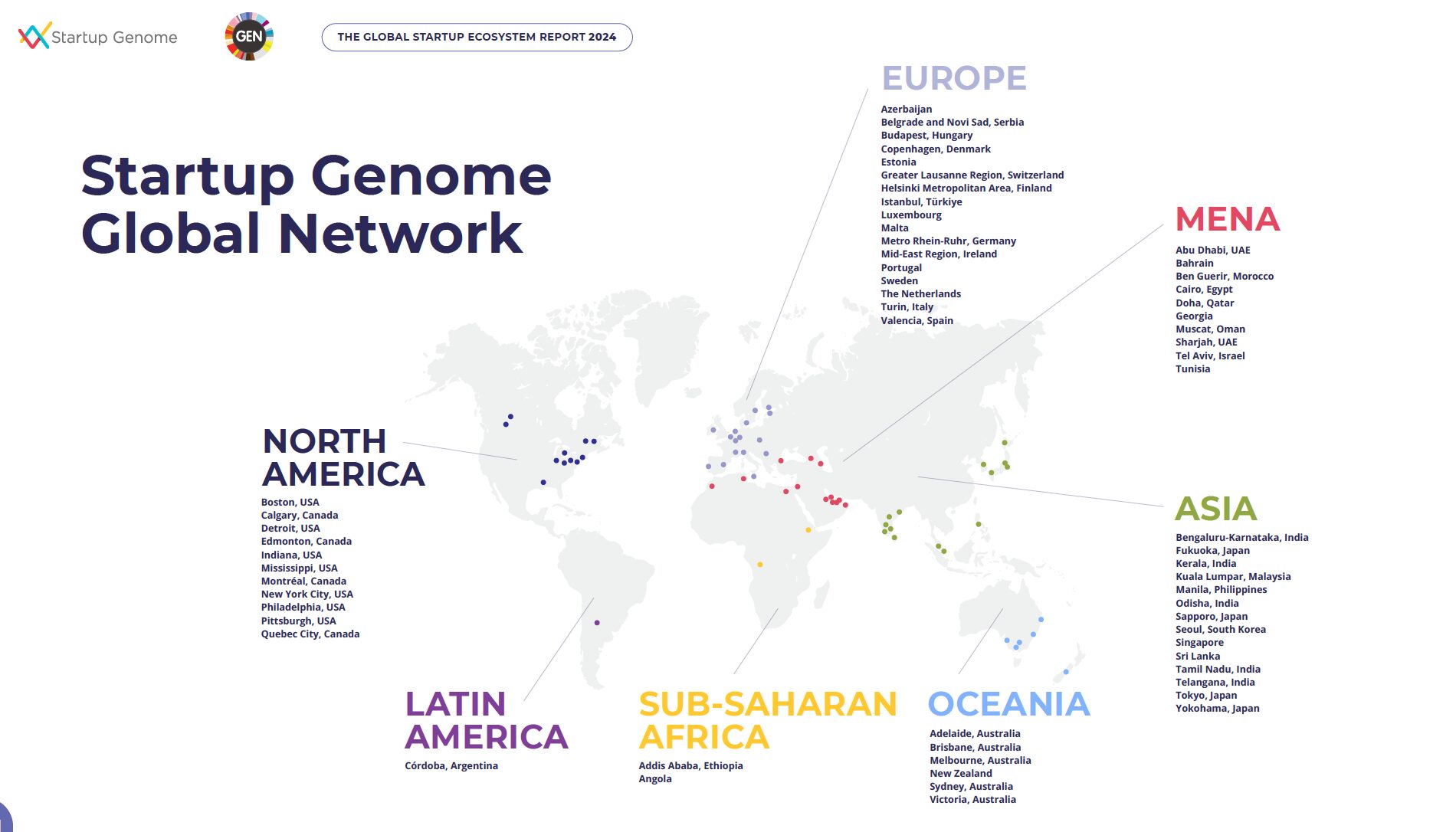

The 2024 edition ranks the top 40 global ecosystems, emerging ecosystems, and an expanded regional analysis. The report, led by a consortium of organizations based in more than 40 countries, examines the current state of startup activity and related investments. It also highlights startup communities from a regional perspective, separately classifying ecosystems in Asia, Europe, Latin America, MENA, North America, Oceania, and sub-Saharan Africa.

“Creating more entrepreneurs is the most important thing we can do as an ecosystem of facilitators and policymakers. Entrepreneurs are naturally attracted to the most important challenges of the moment and seek to apply the best ideas and technologies to find solutions. The progress we make on these issues in the next decade will determine the success of the next hundred years and beyond. The prize is to find solutions to global needs more quickly. That’s why we stay the course and work day and night to build an environment where ordinary citizens are able to become entrepreneurs and thrive in healthy, growing ecosystems,” says Jonathan Ortmans, president of the Global Entrepreneurship Network.

The GSER was created in collaboration with the Global Entrepreneurship Network, Dealroom, Crunchbase and Bella Private Markets. The 2024 edition aims to provide guidance to public and private leaders on how to foster thriving startup communities that are the number one engine of job creation and economic growth.

In more detail, the report in its latest edition finds that the top three ecosystems maintained the same positions as in 2020, with Silicon Valley remaining at the top, followed by New York City and London tied for second place. Seoul moved up three places and is now in ninth place, entering the top 10 ecosystems this year. Tokyo entered the top 10 for the first time, rising five places to 10th from 15th in GSER 2023, marking the most significant improvement among the top 10 ecosystems. Miami has made impressive progress, reaching 16th place in the top 20 ecosystems, an improvement of seven places from last year. China’s top two ecosystems dropped in the overall ranking: Beijing dropped one place to 8th and Shanghai dropped two places to 11th. Shenzhen showed impressive growth, rising seven places to 28th place. Paris moved up four places from last year to 14th place. Zurich climbed five places to 31st, and Munich climbed four places to 33rd.

Emerging ecosystems

Looking at emerging ecosystems, then startup communities in the early stages of growth the report applies a methodology that is designed to reflect this and shows ecosystems with high potential to become top global performers in the coming years. The factor weights used to rank these ecosystems differ slightly from those used for the top ecosystems to reflect their emerging status and to emphasize the factors that are most influential in ecosystems that are just beginning to grow. The number of exits above $50 million carries less weight, and startup activity focuses more on early-stage funding than the top 40 ecosystems. The top 100 emerging ecosystems collectively have an ecosystem value of more than $1.6 billion, up slightly from 2022. Europe is the most represented region in the emerging ecosystems ranking, with a 42 percent share in the top 100 emerging ecosystems, followed by North America with a 27 percent share. Madrid climbed 12 places, taking the top spot, thanks to large exits and unicorns. Barcelona moved up two places from last year to second place. Barcelona is home to three unicorns, with the highest-rated unicorn, TravelPerk, valued at $1.6 billion. Jakarta and the Rhein-Ruhr metropolitan area in Germany both made it into the top 10 emerging ecosystems, ranking 6th and 9th respectively. The Lausanne region climbed 16 places to position number 11. Milan climbed 14 places to 14th place. Mexico City, the top emerging ecosystem in Latin America, showed impressive growth, reaching the 21-30 range from the 41-50 range in 2023, thanks to an increase in releases above $50 million. The highest-rated unicorn, the fintech platform Viva Wallet, was valued at $1.7 billion, helping to increase the value of the ecosystem to $4.2 billion, up 40 percent from 2023.

Asia

There are 10 Asian ecosystems in the top 40. Singapore moved up one place from GSER 2023, ranking 7th among global startup ecosystems. The ecosystem created $144 billion from July 1, 2021 to December 31, 2023. Ecosystem value is a measure of economic impact, calculated as the value of startups’ outputs and valuations. Tokyo and Seoul made the most significant strides among the top 10 ecosystems this year. Seoul improved three places to ninth, its best performance since 2022, when it was 10th. In 2023, Tokyo recorded 11 large exits (over $50 million), tied with Boston and behind only Silicon Valley for the most exits among the 10 global ecosystems. Shenzhen showed impressive growth, rising seven places to 28th place. Hangzhou is ranked 36th. Bengaluru-Karnataka in India is the 21st largest global startup ecosystem (tied with Sydney), having created $158 billion in ecosystem value from July 1, 2021 to Dec. 31, 2023. India has two ecosystems in the top 40, Delhi at 24th and Mumbai at 37th.

Europe

Nine European ecosystems are in the top 40. London remains the best performing ecosystem in Europe, ranking first in Europe and second globally (tied with New York City). The Netherlands moved up one place, both regionally and globally, to second in Europe and 13th in the global rankings. The ecosystem created $96 billion in value from July 1, 2021 to December 31, 2023. Paris has risen to third place in Europe, it is the rare ecosystem that has not had a sharp decline in the number of exits since 2021, its 289 total exits from 2022 to 2023 are the 5th highest globally. Zurich moved up five places, to 31st place in GSER 2024. Munich climbed four places to 33rd with seven major exits, ranking 5th among European ecosystems. In 2023, Copenhagen’s fintech startups secured the third largest VC funding per capita among Europe’s top 10 ecosystems.

Latin America

Remaining in 26th place globally, São Paulo is the only Latin American ecosystem in the top 40 ranking. São Paulo, Mexico City, Bogotá, Santiago-Valparaiso and Buenos Aires are the top five ecosystems in Latin America. This is followed by Rio de Janeiro, Curitiba, Monterrey, Belo Horizonte, and Montevideo, which rank as ecosystems in positions 6-10 in Latin America. São Paulo ranks first among Latin American ecosystems for knowledge, measuring innovation through research and patent activity, and first among Latin American ecosystems for performance, measuring the size and performance of an ecosystem by the accumulated value of tech startups created by exits and funding. It is the first Latin American ecosystem in terms of funding, which measures innovation through early-stage funding and investor activity, and the first Latin American ecosystem in terms of talent & experience, which measures long-term trends in the most significant performance factors and the ability to generate and retain talent in the ecosystem. Buenos Aires is the top Latin American ecosystem in terms of affordable talent, which measures the ability to hire tech talent. Mexico City scores 9 out of 10 in funding, which measures innovation through early-stage funding and investor activity. Córdoba recorded 287 percent growth in ecosystem value, having created $321 million in value from July 1, 2021 to December 31, 2023. Ecosystem Value is a measure of economic impact, calculated as the value of startup exits and valuations.

North America

Eighteen of the top 40 ecosystems are based in North America, including three in Canada and the rest in the United States. North America is the second most represented region in the emerging ecosystem ranking, with a 27 percent share. Toronto-Waterloo remains Canada’s top ecosystem, although it drops one place to 18th. With Vancouver dropping four places to 34th and Montréal gaining one place to 39th, they remain the second and third Canadian ecosystems in the rankings. The United States leads all countries in new unicorns for 2023, with 57 percent of the global share. In 2023, U.S.-based genAI startups increased by 27 percent. In 2023, U.S.-based genAI startups increased their share of all VC transactions to 65 percent, up from 57 percent in 2022. Silicon Valley accounts for 59% of the total ecosystem value within the top 5 global ecosystems, up 3% from last year. A significant factor in Silicon Valley’s success has been late-stage financing (Series B+). New York City is ranked second globally, tied with London. The ecosystem created $694 billion in ecosystem value from July 1, 2021 to Dec. 31. New York City was the only ecosystem in the top 5 to see a slight increase in the value of its large exits (over $50 million) in 2023 compared to 2022, although its number of large exits decreased. Los Angeles remains the 4th largest global startup ecosystem. The value of its large exits (over $50 million) fell 36 percent in 2023 compared to 2022, a smaller decline than in London and Silicon Valley. Boston recorded 11 major exits, tied with Tokyo and behind only Silicon Valley for the most exits among the 10 global ecosystems. After rising 10 positions from 2022 to 2023, Miami climbed another seven positions from 23rd last year to 16th this year. Seattle startups secured 49 late-stage deals (Series B+), 5th among U.S. ecosystems. Seattle suffered the steepest decline among the top 40 ecosystems, minus 10 places to 20th. Its 10 major exits in the 30 months before the end of 2023 were ranked 26th globally. Philadelphia moved up two places, ranking 25th among global startup ecosystems. Created $92 billion in ecosystem value from July 01, 2021 to December 31, 2023, or 40 percent compound annual value.

MENA

Dubai scored 10 out of 10 in the funding ranking, which measures innovation through early-stage funding and investor activity. It has five unicorns, one of 19 emerging ecosystems with four or more unicorns in the last 10 years. Cairo has risen in the emerging ecosystem rankings from the 51-60 range last year to the 41-50 range; it is the top MENA ecosystem in terms of bang for buck, which measures the amount of capital that tech startups acquire, on average, from a VC round. Riyadh and Abu Dhabi both moved up in the emerging ecosystem ranking: Riyadh rose from the 61-70 range last year to the 51-60 range and Abu Dhabi from the 81-90 range to the 61-70 range. Abu Dhabi ranks second among MENA ecosystems in performance, which measures the size and performance of an ecosystem based on the accumulated value of tech startups created by exits and funding. Muscat created an ecosystem value of $313 million from July 1, 2021 to December 31, 2023. Sharjah created an ecosystem value of $424 million from July 1, 2021 to December 31, 2023.

Oceania

The top five ecosystems in Oceania are Sydney, Melbourne, New Zealand, Brisbane and Adelaide. Melbourne climbed one place to become the 32nd global ecosystem for startups and the 1st ecosystem in Oceania for talent and experience, measuring long-term trends in the most significant performance factors and the ability to generate and retain talent in the ecosystem. Adelaide is Oceania’s first ecosystem in affordable talent, which measures the ability to hire tech talent, and Oceania’s third ecosystem in bang for buck, which measures the amount of space available for businesses.

Sub-Saharan Africa

Nairobi is sub-Saharan Africa’s top performing ecosystem, which measures the size and performance of an ecosystem by the value accumulated by tech startups through exits and funding. Lagos is Sub-Saharan Africa’s premier funding ecosystem, measuring innovation through early-stage funding and investor activity. Cape Town remained in the 91-100 range of emerging ecosystems, but ranked first among sub-Saharan African ecosystems for talent and experience, measuring long-term trends on the most significant performance factors. Johannesburg is Sub-Saharan Africa’s premier knowledge ecosystem, measuring innovation through research and patent activity.

The full report can be downloaded from this link

ALL RIGHTS RESERVED ©